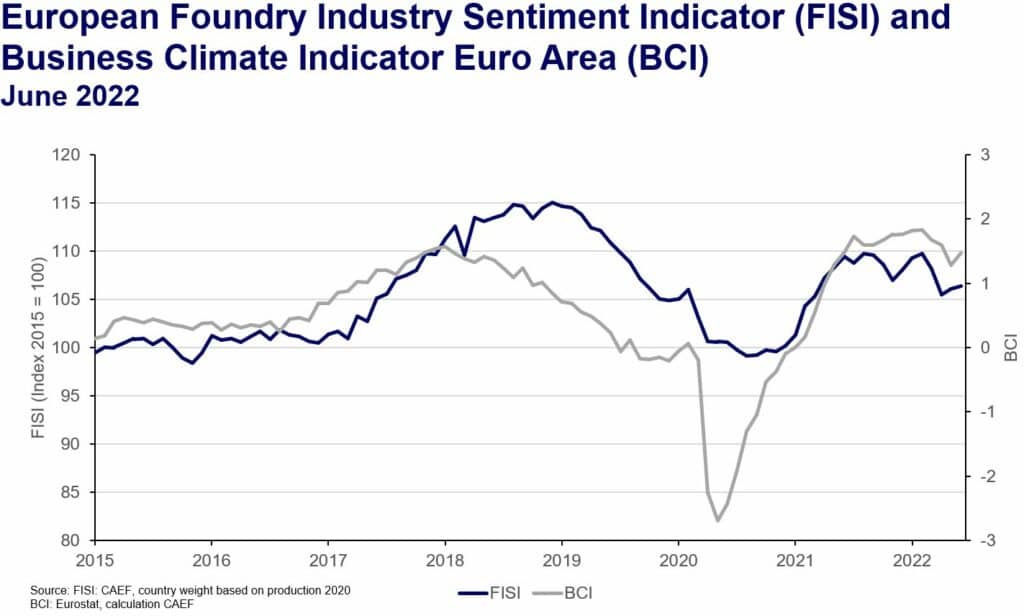

The European Foundry Industry Sentiment Indicator (FISI) increased by 0.4 points in June and reaches a value of 106.4 points. After the significant drop due to Russia’s invasion of Ukraine, the business climate of the European foundries is stabilising for the time being, despite all the uncertainties. While the assessment of the current business situation is slightly declining, the expectations for the coming six months are improving moderately. The historic drop of the FISI in recent weeks was, however, due to the latter. The fact that companies’ expectations are riding a rollercoaster given the great uncertainties is one of the few things that is momentarily certain.

The question of how much gas Russia will continue to supply in the coming weeks and months is the focus of public discussions. At the same time, energy prices are already threatening the existence of businesses in many places. Switching to alternative energy sources sometimes requires horrendous investments which, after two and a half years of the pandemic, now come up against rising interest rates. Clients of foundries also need to be aware of this. Thus, producer prices for cast components continue to rise.

Meanwhile the Business Climate Indicator (BCI) decreased in May. The increase of 0.19 points brings the index to 1.47 points. After a rally in expectations of rising sales prices, which peaked in April, the situation is easing slightly. Meanwhile, rising incoming orders are giving the BCI a moderate boost.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu