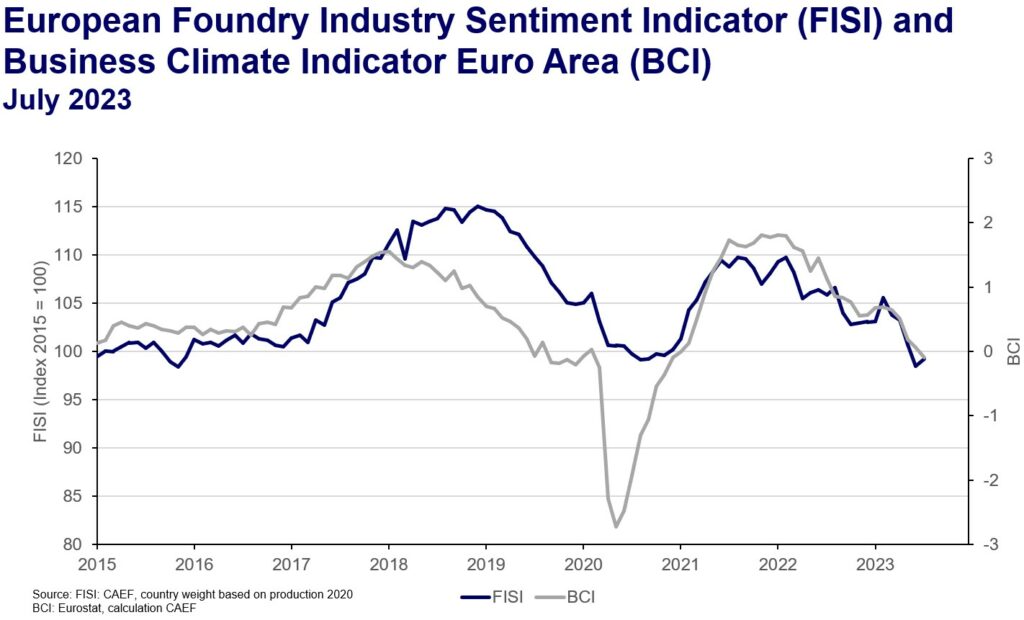

July 2023: Hope on the Horizon: FISI with first increase since February

The European Foundry Industry Sentiment Indicator (FISI) records its first increase since February this year. Rating of 0.7 index points higher than in June, the index reaches a value of 99.2 points in July.

The foundry industry is still grappling with multiple challenges. As in the previous months order backlogs are being worked off, while new orders fall short again. The ongoing decline in raw material prices is having a relieving effect. Nevertheless, this must be seen in the context of a faltering global economy, which is generating less and less impulses for demand. Nevertheless, it’s important to note that the holiday season could potentially introduce a bias into the reports. In the preceding month, there was no notable shift in political decision-making or the general industrial landscape. This status quo may be attributed, in part, to the impact of the ongoing political summer break. Following the latest developments there is no turnaround in sight.

Meanwhile the Business Climate Indicator (BCI) decreased in July. The decrease of 0.15 points brings the index to ‑0.09 points. It is the first time since January 2021 that the BCI falls below the threshold of 0 points and is therefore negative again. The decline of the BCI below 0 index points can be explained by fragile expectations in the industry. Both production and employment expectations for the month ahead have turned negative for the first time since 2020.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu