August 2024:

European Foundry Industry Sentiment, August 2024: FISI Sees a Slight Decline in August

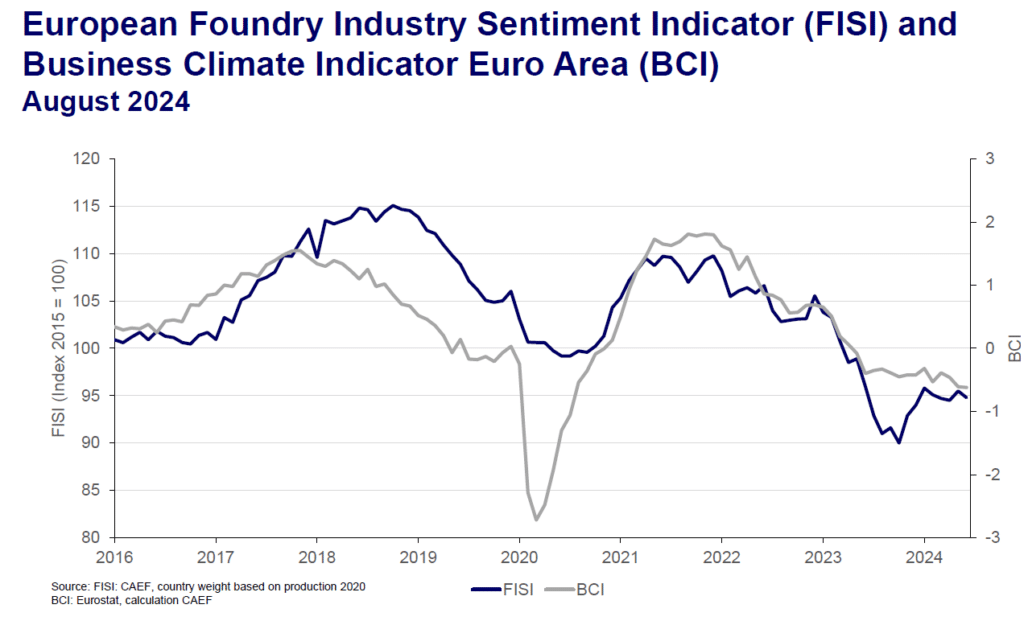

In August 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a slight decline, falling to 94.8 index points. This represents a decrease of 0.7 points compared to the previous month, where the index stood at 95.5.

This decrease can be partly attributed to the ongoing complex macroeconomic situation across Europe. Despite some improvement in energy prices and raw material costs, both of which are no longer at their peaks, the overall economic outlook remains somewhat stagnant. Many economies across Europe continue to move sideways rather than demonstrating significant upward momentum, leading to a noticeable lack of new orders. Adding to this uncertainty is the upcoming U.S. presidential election in 2024, which is causing many customers to delay decisions until the outcome is clear. This is particularly relevant for industries with global supply chains, as the potential policy shifts could have far-reaching implications. Similarly, the formation of the new EU Commission is also creating a wait-and see attitude among customers, as businesses remain cautious about future regulatory changes within the European market.

Despite this downturn, there is a modest sense of optimism in the outlook. The current market conditions, however, highlight the ongoing challenges that the foundry industry in Europe must contend with.

Meanwhile, the Business Climate Indicator (BCI) continued its downward trend in August, slipping from ‑0.61 to ‑0.62 index points. This slight decline underscores the ongoing difficulties in the business environment, as the BCI remains significantly below the neutral threshold of 0 index points. The drop in the BCI for August can be linked to various factors. Firstly, businesses are expressing a more subdued outlook on order book levels, indicating weakening demand prospects within the industry. This decline in orders raises concerns over production capacity in the coming months. Additionally, the typical summer lull in economic activity has further compounded the slowdown. Lastly, ongoing uncertainty about the composition and policies of the upcoming EU Commission has led to increased caution among businesses, contributing to the overall subdued sentiment. Taken together, these elements paint a more cautious picture of the business climate, with companies remaining hesitant about both short-term and long-term economic prospects.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu