October 2024:

European Foundry Industry Sentiment, October 2024: FISI reflects intensified market challenges

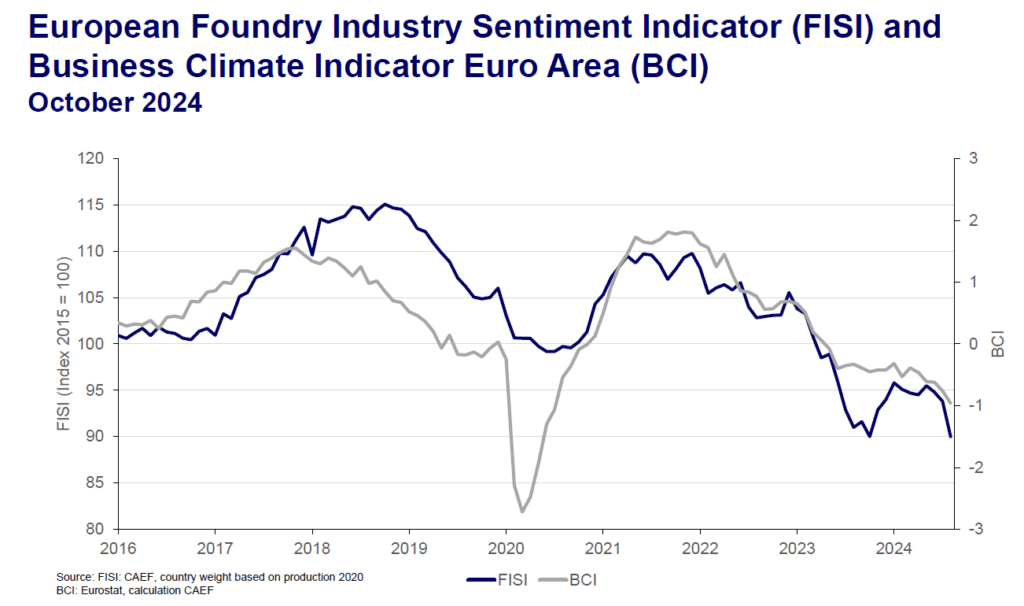

In October 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a significant drop, falling to 90.0 index points from 93.8 in September. This decline marks one of the sharpest monthly downturns of the year, underscoring the worsening challenges faced by the foundry sector.

This downward trend highlights deteriorating conditions within the foundry sector, especially in crucial client industries like construction and automotive. High interest rates, rising production

costs, and reduced demand continue to weigh heavily on foundry operations. The construction sector, a significant consumer of cast products, remains in a prolonged downturn, curbing orders for structural components. Meanwhile, the automotive industry has shown signs of slowing, reducing demand for specialized castings needed for vehicle manufacturing. Geopolitical tensions, including the ongoing Russia-Ukraine conflict, have further disrupted supply chains and added to market instability. While energy prices have slightly moderated compared to their peak, elevated grid costs and inflationary pressures persist, exacerbating operational challenges for foundries.

At the same time, volatile raw material markets and fluctuating scrap prices complicate production planning and cost management. Despite these pressures, there are areas of cautious optimism. Investments in infrastructure projects and renewable energy are driving localized demand for foundry products, particularly those supporting green transitions. Nonetheless, overall sentiment in the sector remains subdued, with many foundries anticipating continued volatility and uncertainty into 2025.

The Business Climate Indicator (BCI) in October continued its downward trajectory, dropping from ‑0.73 to ‑0.96. This decline reflects deepening challenges across Europe’s industrial landscape, marked by weak demand in critical sectors such as automotive, construction, and machinery. Manufacturers are increasingly cautious, navigating sluggish global demand coupled with elevated production costs.

Europe’s economic growth remains under pressure, further strained by China’s prolonged economic difficulties, which have limited export opportunities—a crucial revenue stream for many European manufacturers. Inflation in the eurozone, while gradually slowing, continues to undermine both consumer spending and industrial confidence, exacerbating uncertainty within the market.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu