November 2024:

European Foundry Industry Sentiment, November 2024: FISI reflects persistent challenges amid global instability

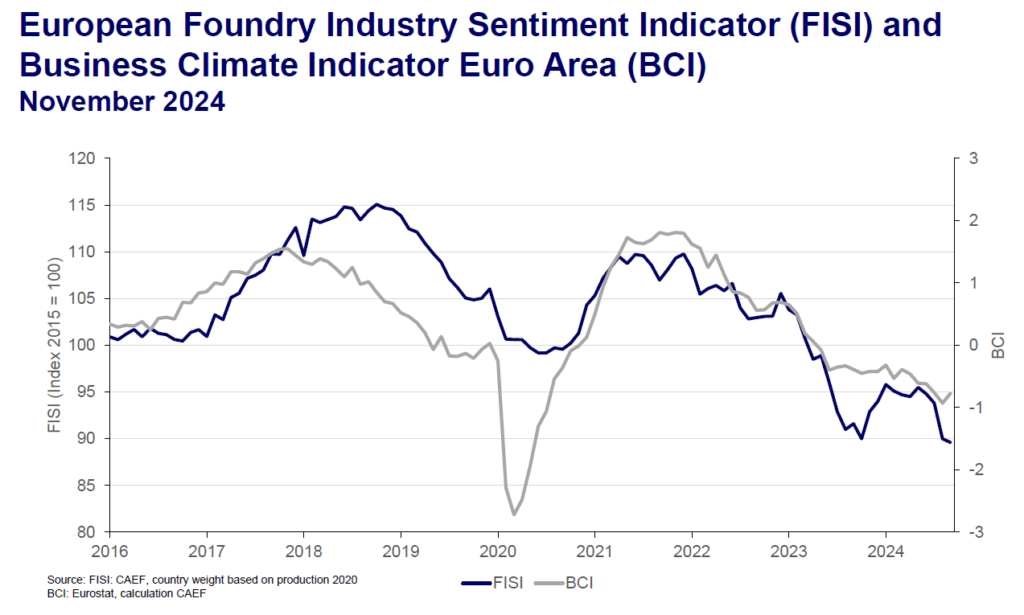

In November 2024, the European Foundry Industry Sentiment Indicator (FISI) edged down slightly, moving from 90.0 in November to 89.6. This decline underscores the ongoing challenges within the foundry sector, exacerbated by economic and geopolitical turbulence. Meanwhile, the Business Climate Indicator (BCI) displayed a modest improvement, rising from ‑0.93 to ‑0.77, indicating cautious optimism in broader industrial expectations. Key client industries such as construction and automotive remain under strain. The construction sector continues to grapple with high interest rates, limiting investment in infrastructure projects and reducing orders for cast components. The automotive industry, still adapting to the transition towards electric vehicles, faces sluggish demand for specialized castings, further dampening production outlooks. Adding to these challenges is the election of Donald Trump as U.S. president-elect, a development that has introduced new uncertaintiesinto the global economic landscape. Trump’s policies, which historically emphasized protectionism and aggressive trade measures, have raised concerns over potential new tariffs, trade disruptions, and supply chain realignments. For European manufacturers, this could translate into higher costs and restricted market access, particularly if his administration follows through on proposed tariffs targeting Chinese and European goods.

The ongoing Russia-Ukraine conflict continues to pose challenges for global trade and supply chains, but its impacts have evolved. Traditional supply routes remain disrupted, particularly in the Black Sea region, complicating logistics for energy and agricultural commodities. However, businesses have increasingly adapted through regionalizing supply chains and securing alternative sources. Despite these adjustments, energy costs and inflationary pressures persist, influenced by sanctions and market volatility. The war has underscored the importance of supply chain resilience, prompting shifts such as “friend-shoring” and enhanced inventory strategies to mitigate risks. These developments also reflect broader geopolitical shifts, as nations reevaluate dependencies on critical raw materials from conflict zones.

As the year concludes, the foundry sector faces a volatile mix of risks and opportunities. While cautious optimism exists in some areas, overall sentiment suggests that many players are bracing for continued uncertainty into 2025.

The Business Climate Indicator (BCI) reversed its prior decline, improving from ‑0.93 to ‑0.77 in November. This modest rise suggests slight optimism in Europe’s manufacturing outlook despite persistent challenges. Critical sectors such as automotive, construction, and machinery continue to face headwinds from sluggish global demand and high production costs, exacerbated by geopolitical uncertainties.

Additionally, manufacturers are increasingly implementing efficiency measures and digital transformation strategies to counteract cost pressures and position themselves competitively for 2025. This improvement in the BCI, though tentative, reflects a recognition that with strategic adjustments and resilience, Europe’s industrial base can weather the uncertainties of a challenging global environment.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu