March 2021: Further improvement of the current business situation

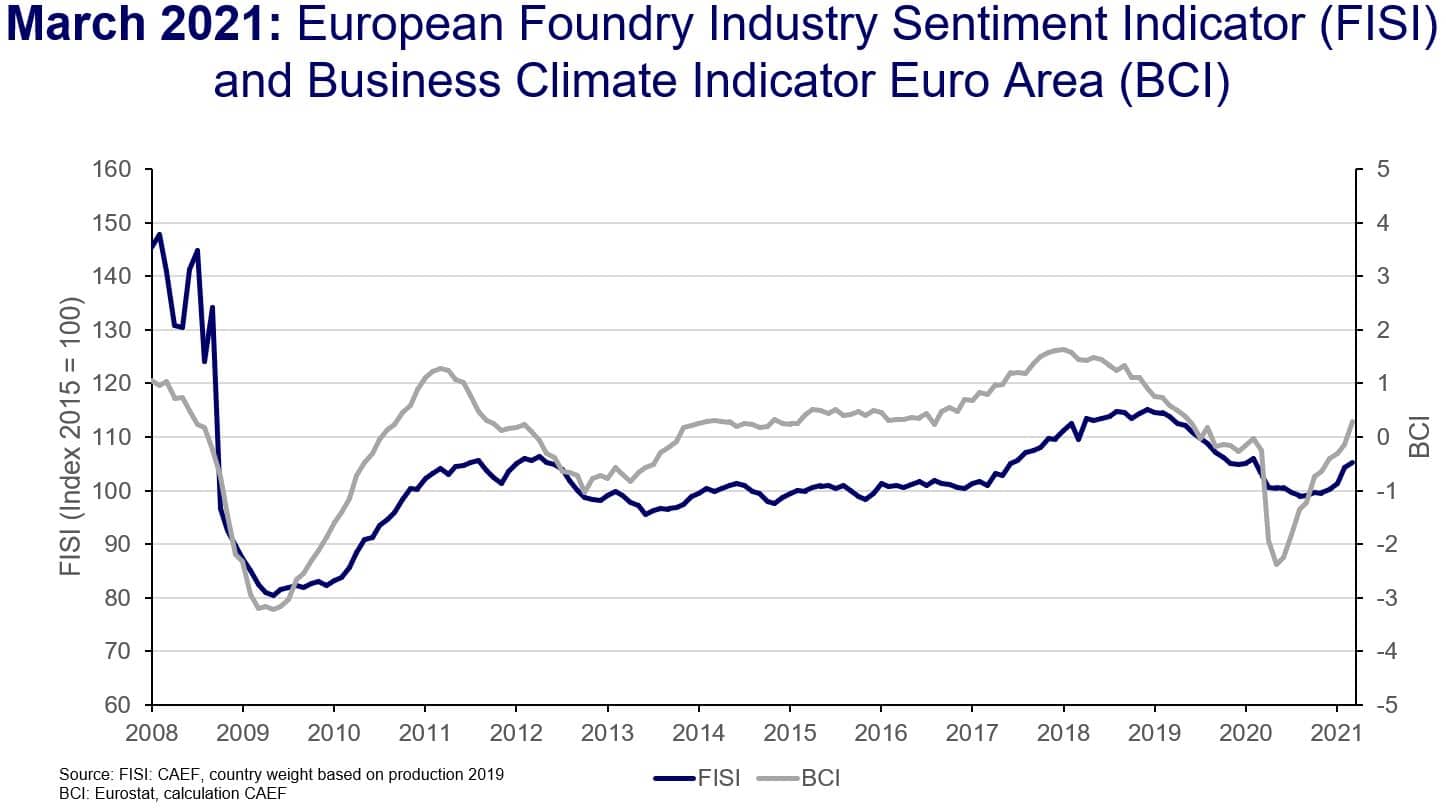

The European Foundry Industry Sentiment Indicator (FISI) continues its recovery trend. Compared to the historical previous month, however, the recovery of the European foundries’ business climate loses dynamics. With an increase of 1.0 index points in March, the first quarter closes at a level of 105.3 points and is thereby roughly at the pre-crisis level again.

The driving forces for this increase are the assessments of the current situation among iron and steel foundries. Meanwhile, the non-ferrous foundries are suffering from the continuing uncertainties in international vehicle manufacturing, which for months are determined by supply bottlenecks of semiconductors. In addition, the enthusiasm of the previous month has been dampened by a slightly negative sideways movement of expectations.The moderately more sceptical outlook for the coming months is mainly caused by the discussions and uncertainties regarding the supply and usage of vaccines, which in March disrupted the vaccination strategies of several European countries.

Meanwhile, the Eurozone Business Confidence Indicator (BCI) is back in positive terrain for the first time since August 2019. The index has increased for the tenth consecutive month and is now at the new level of 0.29, following the 0.4 points improvement.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu