July 2021: Summer slump or signs of a setback?

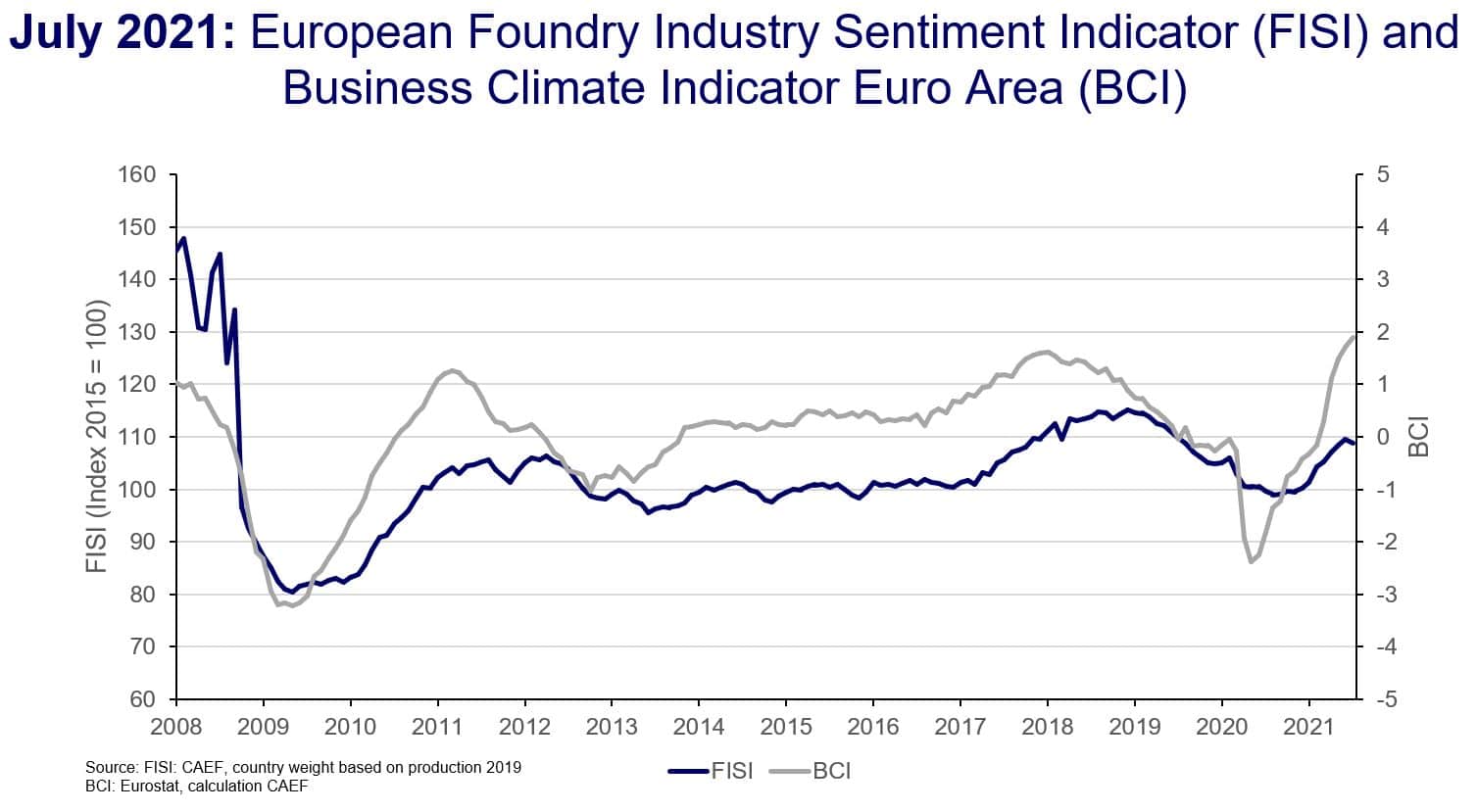

In July the European Foundry Sentiment Indicator (FISI) dropped for the first time since exactly one year. The decrease of 0.8 points brings the index to a value of 108.7. Both the current situation and the expectations for the next six months are assessed slightly worse by the European foundries than in the previous month. This development does not yet represent a clear setback. Nevertheless, in particular the high raw material prices and the still tense situation in logistics as well as the problems in the vehicle construction industry are impacting the sentiment among European foundries.

Meanwhile, the slight dampener impressively shows that a further recovery is fragile even with a good order situation. It remains to be seen whether this is only an interruption in the upswing or if the recovery will lose momentum in the coming months. The more the catch-up effects of the crisis are overcome, the greater will the multiple challenges of industrial transformation also be felt by the foundries.

At the same time, the Business Climate Indicator (BCI) continues its record reaching improvement in July. The increase of 0.20 points raises the index to its record level of 1.90 points. The current business situation is assessed as overall positive due to the excellent order-book levels from EU and non-EU countries. Therefore, the parameter for employment expectations is reaching its highest level since the beginning of the records in 1985, just like in December 2017.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu