November 2021: Throwback at the end of the year

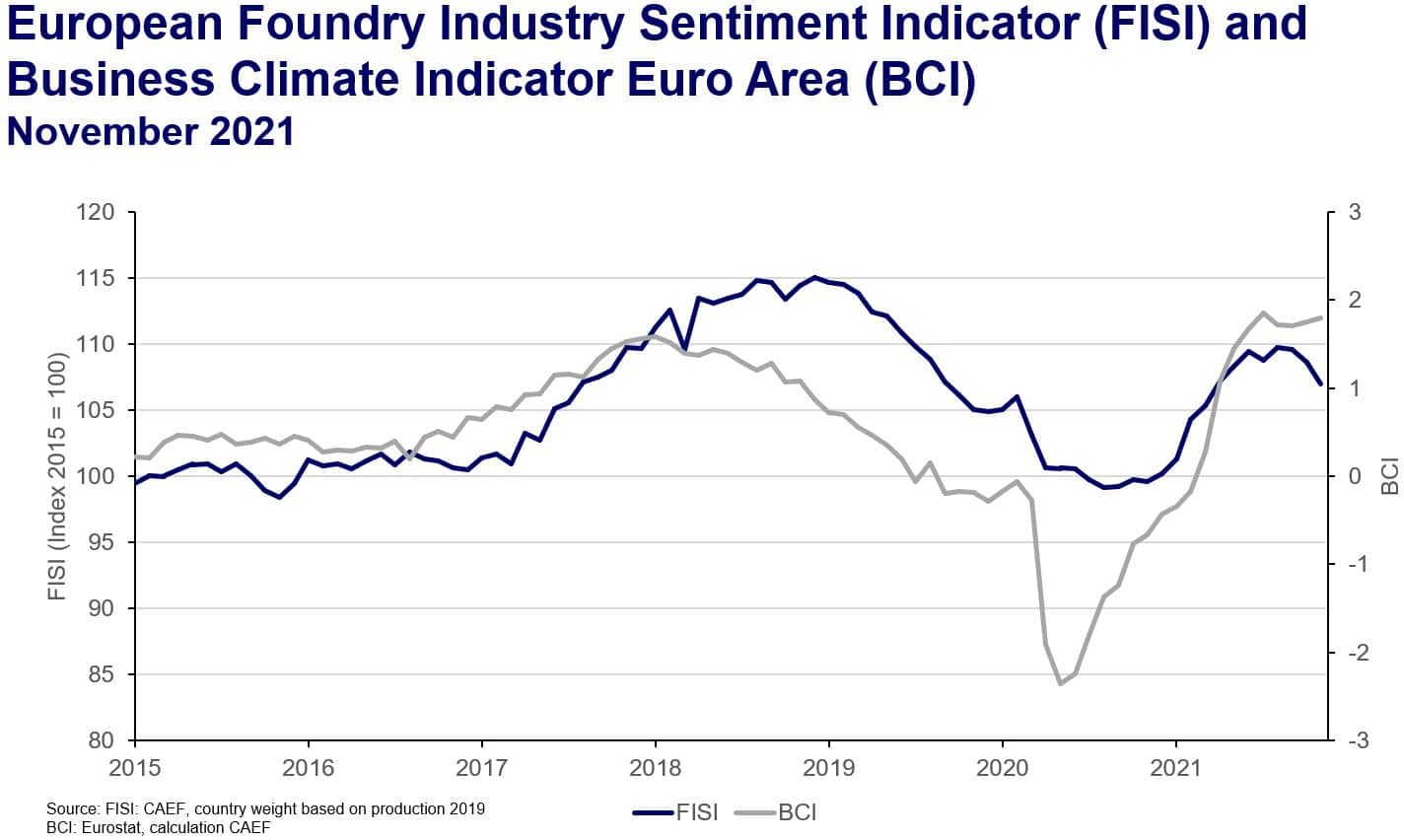

While the assessment of the current business situation for non-ferrous metal foundries has been declining in stages since June, the situation for iron foundries has so far remained stable at a high level due to the very good order situation from the mechanical engineering sector. Many order books are full, however due to the considerable cost explosion for raw materials and energy, the business situation has now deteriorated significantly. Meanwhile, there is no prospect of improvement in the coming months. The negative trend in expectations for the next six months continues. The European Foundry Industry Sentiment Indicator (FISI) decreases from 108.6 to 107.0 points in November 2021.

The new Omicron variant of the coronavirus, which seems to be more infectious than the dangerous Delta variant, is causing uncertainty and concern, similar to the second wave of infection last year before Christmas. Booster vaccinations need to be ramped up across Europe soon to avoid further overloading of health systems and worsening consequences for society and the economy.

At the same time, the Business Climate Indicator (BCI) remains on a high level in November. The slight increase of 0.05 points brings the index to its to 1.80 points. In particular, the sales price expectations for the coming months are increasing the BCI.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu