May 2022: Stabilization of European foundries in uncertain times

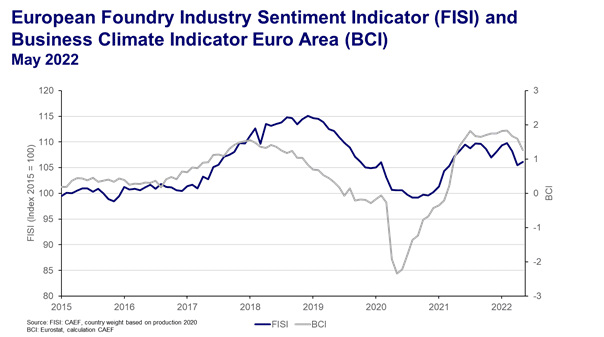

The European Foundry Industry Sentiment Indicator (FISI) increased by 0.6 points in May and reaches a value of 106.1 points. After the highest loss since the outbreak of corona pandemic in Europe in March 2020 the FISI has slightly recovered.

After the decline in the previous months was caused by a war-related drop in business expectations for the upcoming six months, European foundries are now increasingly experiencing some positive effects on their business situation.

While the sanctions against Russia were steadily tightened in March and April and the problems in the supply chains remain very apparent, several foundries seem to receive orders in the wake of relocalization. The global disruptions in the logistics industry have supported this trend and the willingness of customers to ramp up production in Europe. On the demand side, May has continued to be characterised by uncertainties in European vehicle manufacturing. In particular, short-term orders and cancellations along several vehicle OEMs led to postponed and cancelled call-offs at supplying foundries. Contrary, the mechanical engineering sector continues to be characterised by a historically good order situation and high capacity utilization. Serving these orders is nevertheless a challenge for many foundries given the difficulties in production planning and raw material costs as well as availability. As such a twofold development in vehicle production and general engineering can be observed.

Meanwhile the Business Climate Indicator (BCI) decreased in May. The noticeable decrease of 0.33 points brings the index to 1.26 points. After the record level in April, the decrease is in line with the development of the FISI, following similar arguments. The downturn at the main stock exchanges and the fear of a recession are additional causes for the BCI to decline.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu