August 2022: Last breath before the downhill ride?

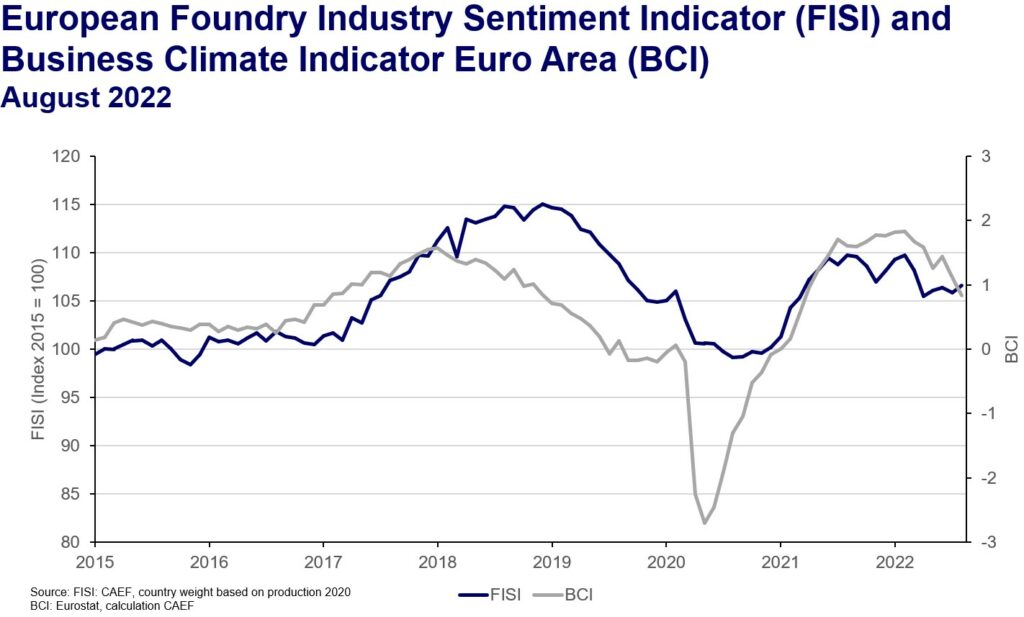

The European Foundry Industry Sentiment Indicator (FISI) increased by 0.8 points in August and reaches a value of 106.6 points. Both the expectations for the next six months and the assessment of the current business situation are still robust in the summer month. However, it should be said in advance that holiday season might have a biasing effect on the reports.

Meanwhile, the economic situation does not promise any easing. Although the Ukrainian military was able to achieve remarkable successes in August, which initially had a positive effect on energy prices, it is already becoming apparent in September that the war in Ukraine will reach a new dangerous level of escalation after the fake referendums and the partial mobilisation of Russia. For the formation of the procurement costs of European foundries, such reports are certainly significant, since not only but above all the pricing of energy now has more to do with speculation than with the real economy at the moment. The successes in energy saving that have been recorded throughout Europe in recent weeks are mainly linked to the efforts of the industry. Unfortunately, this is also due to a reduction in production, which is affecting the foundries as well. It remains to be seen what effect the start of the heating period will have in the coming weeks. If the gas reserves start to drop again in the near future, the nerves could be on edge again very soon. Meanwhile, more and more businesses are finally being hit by energy costs, as old contracts expire and the number of companies that have to produce under the new conditions is steadily increasing.

Meanwhile the Business Climate Indicator (BCI) decreased in August. The decrease of 0.28 points brings the index to 0.83 points. Declining new orders and a negative production trend in recent weeks are significantly darkening the business climate.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu