December 2022: Unclear market signals and little impulse

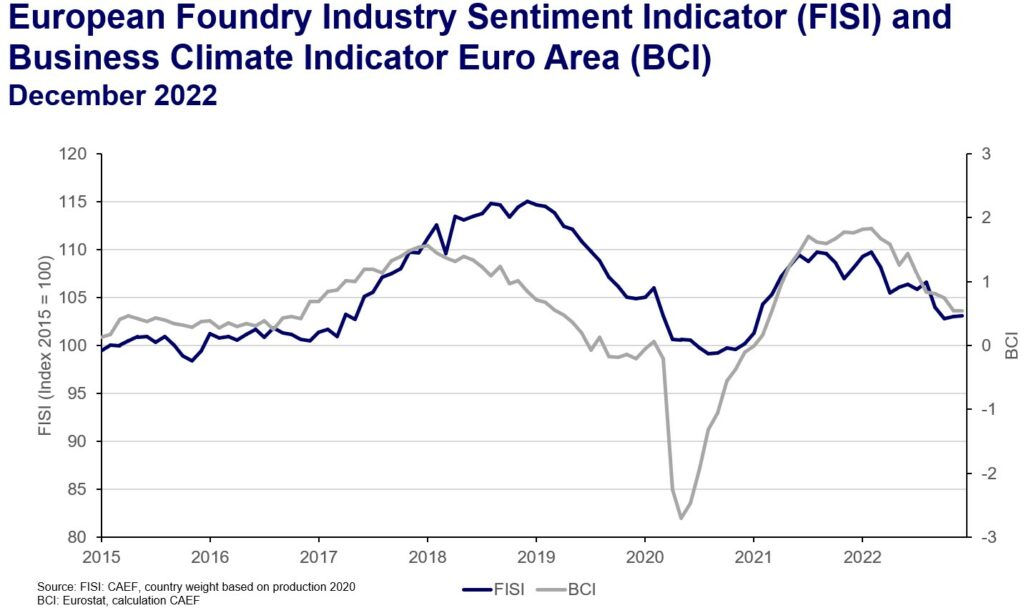

The European Foundry Industry Sentiment Indicator (FISI) moves sideways in December. A minor improvement by 0.1 points brings the index to a value of 103.1 points. Thus, it is the second month in a row without major changes in the overall calculation. However, single components of the FISI develop differently. While business expectations for the next six months increased for the first time since August, the assessments of the current business situation decreased in December. While there has been a downturn in the situation of the iron foundries, it is mainly the non-ferrous metal foundries that are providing positive signals.

The European vehicle manufacturing industry is still in a crisis in which OEMs are generating high profits due to lower unit numbers and the focus on high-margin models, while suppliers in the volume market are suffering at the same time. Recently, however, there have been more positive market signals from the vehicle manufacturing sector. While many European countries again have to accept a minus in passenger car registrations for the year 2022, the market with the highest volume, Germany, has grown slightly. This is mainly due to noticeably higher figures in the two final months. However, the fact that PHEV and BEV vehicles stand out also indicates that special effects with regard to a reduction in government subsidies at the turn of the year have caused pull-forward effects. The order backlog for the first half of the year, which is independent of this, nevertheless gives cause for optimism. With slightly more optimistic macroeconomic forecasts, the next few weeks will show where the economy might be heading in 2023.

Meanwhile the Business Climate Indicator (BCI) maintains its level of 0.54 points in December. While the order situation remains good, expectations of further price increases are falling.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu