May 2024:

European Foundry Industry Sentiment, May 2024: After months with a lot of motion, FISI shows sideways movement in May.

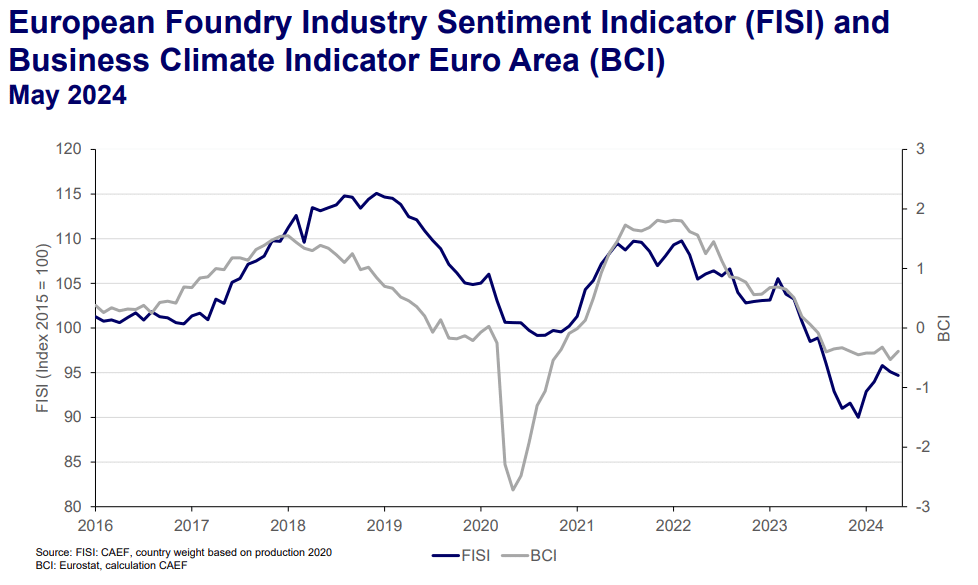

In May 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a minor decrease to 94.7 index points. This development reflects the second consecutive decrease for the FISI, the index experiences a downward movement of 0.4 points, settling at 94.7 compared to 95.1 in the previous month. The FISI has shown minor movement over the past month, reflecting a continued sideways trend in the market. This period of stagnation underscores the ongoing tension within the industry, which persists despite some signs of stabilization earlier this year. Mixed results have been reported, reflecting a diverse range of challenges and opportunities across the European Foundry landscape. While some regions have experienced slight improvements in production and demand, others continue to face significant obstacles, highlighting the uneven nature of the current market conditions. Industry stakeholders are focusing on internal optimizations and strategic planning to navigate the current uncertainties. Companies are closely monitoring global market developments, looking for any signs that could indicate a shift in demand and supply chains. This proactive approach is essential for ensuring the resilience of the industry during these challenging times. While the immediate future may seem uncertain, the European Foundry Industry continues to demonstrate resilience. Uncertainty and expectations are the defining parameters at the moment. Despite the lack of significant movement in the FISI, the industry remains hopeful for a more positive outlook in the latter part of the year.

Meanwhile the Business Climate Indicator (BCI) increased noticeable and now stands at — 0.39 index points. This marks the tenth consecutive month that the BCI has lingered below the critical threshold of 0 index points. The recent positive trend in the BCI has been primarily driven by a strong improvement in the production trend observed over recent months. Meanwhile, other contributing factors, such as the assessment of export order-book levels and selling price expectations for the months ahead, have remained relatively stable. Although challenges persist in these areas, the strong production trend signifies a positive development amid the ongoing market uncertainties.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu