September 2024:

European Foundry Industry Sentiment, September 2024: FISI Experiences Continued Decline in September

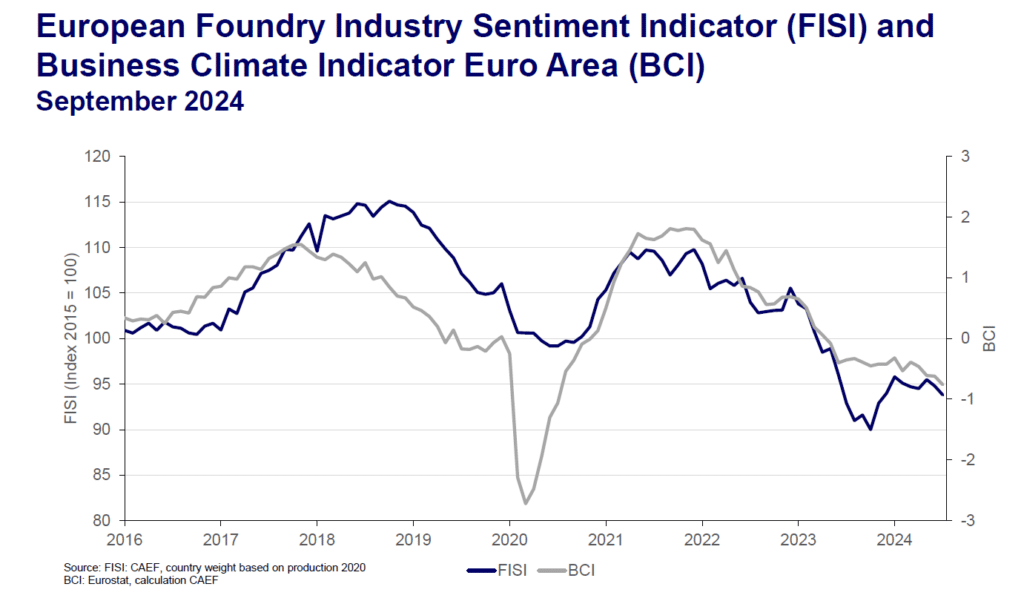

In September 2024, the European Foundry Industry Sentiment Indicator (FISI) saw a further decrease, slipping to 93.8 index points. This represents a drop of 1.0 points compared to the previous month’s reading of 94.8, continuing the gradual downward trend observed in recent months.

This downturn reflects a combination of broader macroeconomic pressures within Europe and ongoing sector-specific challenges. A notable factor affecting foundry sentiment is the recent decrease in raw material prices, including scrap metal, which while beneficial for cost reduction, has been overshadowed by weak demand across multiple industries. Particularly impacted is the construction sector, one of the most significant consumers of foundry products, which continues to face a prolonged downturn as elevated interest rates and tighter budgets constrain new investments.

Concerns over the shifting economic landscape are prompting increased caution across the foundry sector. Anticipated changes within the EU Commission and the forthcoming U.S. presidential election have left businesses and clients alike inclined to delay long-term commitments until there is greater clarity around possible policy changes. Steel and iron foundries, which rely on stable demand from industries like automotive and machinery, are feeling these effects most acutely. Meanwhile, non-ferrous foundries, benefiting from more consistent demand across varied applications, are somewhat more stable but still affected by a general market hesitancy.

While there are glimmers of optimism for gradual recovery, the European foundry industry remains under the influence of both global and regional economic pressures, and many companies expect ongoing market fluctuations as 2025 unfolds.

The Business Climate Indicator (BCI) in September saw a marked decline from ‑0.62 to ‑0.73, reflecting escalating challenges within Europe’s industrial sector. This significant drop mirrors a combination of persistent obstacles: notably low demand across key industries, such as automotive and machinery, and a cautious approach among manufacturers facing both sluggish global demand and high production costs. Europe’s slow economic growth, partly due to China’s weakened post-pandemic recovery, has exacerbated the lack of export demand, which remains crucial for many European manufacturers.

Furthermore, inflation in the eurozone, while slowing, is still impacting consumer and industrial confidence. Supply chain adjustments, alongside broader structural concerns like the green transition and rising labour costs, continue to weigh heavily on sentiment. Consequently, many companies remain hesitant to increase production or investment, awaiting clearer signs of economic stability and policy directions from the upcoming EU Commission

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu